income tax rates 2022 australia

To get a copy of the form you can either. According to the official website The Australian Taxation Office ATO If you have earned AUD 87000 in the financial year of 2021-22 you are eligible to receive a benefits of 1080 tax offset with an additional benefit of AUD 420 for cost of living tax offset.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023.

. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. Place an order to receive it by post or email using our publication ordering service. The new rates will apply in the tax year 202223 and come into effect on 11 April 2022.

Senior Australian wspouse and 0 dependents Each additional dependent 36925 51401 3619 1. The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. ICalculator also includes the following tax tables if you would like us to add additional historical years please get in.

A subsequent Budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 July 2022. There are no changes to most withholding schedules and tax tables for the 202223 income year. Discover Helpful Information And Resources On Taxes From AARP.

Australia personal income tax tables for 2022The Atos Private Binding Rulings Register atotaxratesinfo from atotaxratesinfo19. Tax rates and codes. 26000 plus 37c for each 1 over 80000.

RESIDENT TAX RATES - 2022-23 Taxable income Tax payable excludes medicare 0 18200 Nil 18201 45000 Nil 19 of excess over 18200. 2022 Income Tax Rates Australia. From 1 July 2022Check the fuel tax credit rates from 1 July 2022 to 28 September 2022.

With the annual indexing of the repayment incomes for study and training support loans the following schedule and tax tables were. Important information July 2022 updates. Your 2021 Tax Bracket To See Whats Been Adjusted.

These rates and thresholds are planned to continue until 30 June 2024 after which the next legislated phase of the tax cuts will take effect from 1 July 2024 whereby the 325 and 37 marginal tax rates. The Personal Income Tax Rate in Australia stands at 45 percent. The corporate income tax rate generally is 30.

2 Allowances earnings tips directors fees etc 2022. Personal Income Tax Rate in Australia averaged 4544 percent from 2003 until 2020 reaching an all time high of 47 percent. How to get a copy of the form.

2022 2023 Income Tax Rates Australia. There are seven federal income tax rates in 2022. 39000 37c for each 1 over 120000.

You can find our most popular tax rates and codes listed here or refine your search options below. Budgeting for Future Years. This page contains the personal income tax rates and threshods for 2022 and other associated tax tables used within the Australia salary and tax calculators on iCalculator.

Eligible seniors will not pay Medicare levy. Entitled to Senior and Pensioner Tax Ofset SAPTO. 51667 plus 45 cents for each 1 over 180000.

5 Australian Government allowances and payments 2022. Below are the income tax rates and brackets for Australian residents in the 202122 financial year. The following tables sets out the PIT rates that currently apply to resident and non-resident individuals for the year ending 30 June 2022.

Base rate entity company tax rates. Personal Income Tax Rate in Australia averaged 4544 percent from 2003 until 2020 reaching an all time high of 47 percent in 2004 and a record low of 45 percent in 2007. The more you earn the higher your rate of tax.

5092 plus 325 cents for each 1 over 45000. Total taxable income. Individual income tax for prior yearsThe amount of income tax and the tax rate you pay depends on how much you earn.

What I need to know about 1080 Tax Refund 2022. How to calculate income tax in Australia in 2022. All companies are subject to a federal tax rate of 30 on their taxable income except for small or medium business companies which are subject to a reduced tax rate of 25.

The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you. Calculating income tax in Australia is easy with the.

1 Salary or wages 2022. Non-residents are subject to tax at 325 percent on the first 120000 Australian dollars AUD of income and graduated rates ranging from 37 percent to 45 percent for the remaining income. Company taxThe company tax rates in Australia from 200102 to 202122.

Download the Tax return for individuals 2022 NAT 2541 PDF 709KB This link will download a file. Australian tax brackets and rates 2022. The reduced tax rate applies only to those companies that together with certain connected entities fall below the aggregated turnover threshold of AUD 50 million.

Tax tables for previous years are also available at Tax rates and codes. 4 Employment termination payments ETP 2022. 3 Employer lump sum payments 2022.

Ad Compare Your 2022 Tax Bracket vs. This page provides - Australia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to 41000 and lifting the 325 band ceiling to 120000.

How to calculate income tax in australia in 2022. 6 Australian Government pensions and allowances 2022. To understand how much tax you may need to pay youll first need to look at the current income tax brackets and rates as listed on the ATO website.

Resident tax rates 202122. I have concluded my statutory annual review of benefit and State Pension rates. The companys aggregated turnover for that income year.

However for companies with an aggregate annual turnover of less than AUD 50 million that derive no more than 80 of their assessable income from base rate entity passive income the tax rate is 25 for the 2021-22 and subsequent income years reduced from 26 for the 2020-21 income year. The approved fringe benefit rates must be used in all applications that request salary support beyond June 3 2021. 5 rows low and middle income tax offset lmito income tax rates and thresholds for 2023.

A base rate entity for an income year is a company which meets the following criteria.

Income Tax Assessment Act 1936 Australia 2018 Edition Paperback In 2022 Book Club Books Assessment Independent Publishing

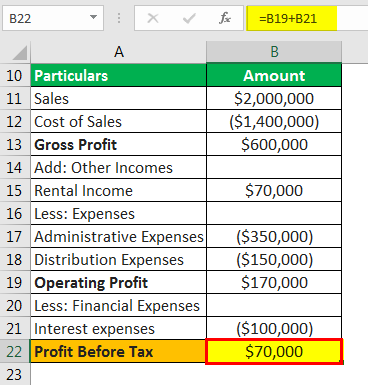

Provision For Income Tax Definition Formula Calculation Examples

Average Tax Rate Definition Taxedu Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Ranked Visualizing The Largest Trading Partners Of The U S In 2022 Teaching History World Data Trading

New 2021 Irs Income Tax Brackets And Phaseouts

Excel Formula Income Tax Bracket Calculation Exceljet

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Learn About Type Of Invoice In Gst Like B2b B2cl B3cs

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)